Introduction

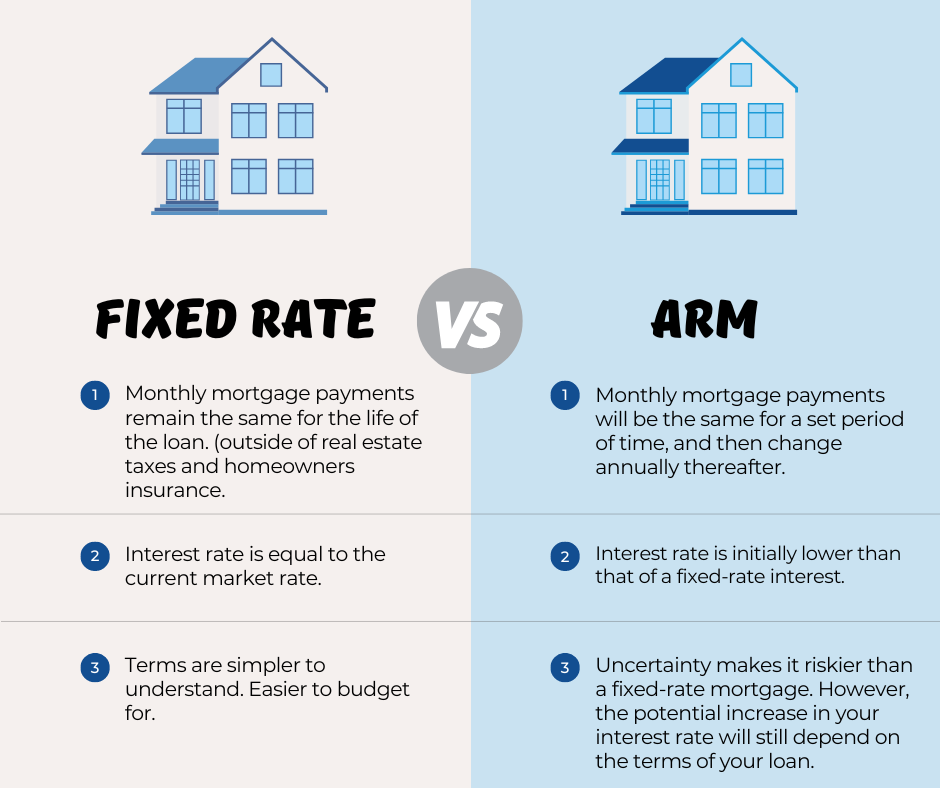

Interest rates are a fundamental aspect of financial decision-making, impacting everything from mortgages to car loans, credit cards, and savings accounts. The two primary types of interest rates you’ll encounter in lending products are fixed and adjustable (also called variable) rates. Each has distinct characteristics, advantages, and risks, making it crucial for borrowers to understand how they work before committing to a loan or investment.

This article delves into the differences between fixed and adjustable interest rates, the current trends and research, and their implications for both borrowers and lenders.

Fixed Interest Rates: Definition and Characteristics

A fixed interest rate is an interest rate that remains the same for the entire term of the loan or investment. This predictability is one of its defining features. For example, if you take out a mortgage with a 4% fixed rate for 30 years, the interest rate will remain at 4% for the entire loan period, regardless of market fluctuations or economic conditions.

Advantages of Fixed Interest Rates:

- Stability and Predictability: With fixed rates, borrowers can easily plan their budgets. Since monthly payments (principal + interest) remain consistent, it’s easier to manage personal finances.

- Protection Against Market Volatility: Fixed rates are insulated from interest rate increases that can occur during economic upturns. Borrowers with fixed rates do not face the risk of sudden jumps in their monthly payments.

- Long-term Certainty: Fixed interest rates are especially attractive for long-term loans like mortgages. The certainty of knowing what your payments will be for decades can provide peace of mind.

Disadvantages of Fixed Interest Rates:

- Higher Initial Rates: Fixed rates are often higher than adjustable rates at the outset, which means borrowers may pay more in interest during the early years of the loan.

- Limited Flexibility: If market rates fall, borrowers with fixed rates are stuck paying the higher rate until they refinance or pay off the loan.

Adjustable Interest Rates (Variable Rates): Definition and Characteristics

An adjustable-rate (or variable-rate) loan has an interest rate that can change over time based on market conditions. This type of rate is typically tied to a benchmark index, such as the LIBOR (London Interbank Offered Rate) or SOFR (Secured Overnight Financing Rate), with a fixed margin added on top.

For example, a mortgage with an adjustable rate might be quoted as “3% + LIBOR,” meaning the interest rate would be 3% above the current LIBOR rate, which can fluctuate based on market conditions.

Advantages of Adjustable Interest Rates:

- Lower Initial Rates: Initially, adjustable rates tend to be lower than fixed rates. This makes them attractive for borrowers who plan to sell or refinance their properties in the short to medium term, potentially saving money on interest.

- Potential for Decreased Payments: If interest rates in the broader market decrease, borrowers with adjustable rates will benefit from lower monthly payments.

- Flexibility: If interest rates remain stable or decrease over time, borrowers can enjoy lower borrowing costs without needing to refinance.

Disadvantages of Adjustable Interest Rates:

- Uncertainty and Risk: The primary disadvantage of adjustable rates is the unpredictability of future payments. If the benchmark rate increases, borrowers will see their monthly payments rise. This can make budgeting more difficult and increase the financial strain during times of economic uncertainty.

- Payment Shock: In some cases, adjustable-rate loans have a feature called “payment shock,” where monthly payments suddenly increase significantly after an initial period with a low rate.

- Complexity: Adjustable rates come with terms that can be hard to understand, such as rate caps, adjustment periods, and payment structures, making them more difficult for the average borrower to fully grasp.

Current Trends in Interest Rates (2025)

As of 2025, interest rates have been influenced by several macroeconomic factors, including inflation, the Federal Reserve’s monetary policy, and global economic conditions. Central banks around the world have adjusted their interest rate policies in response to inflationary pressures and economic growth challenges, which has created a more volatile interest rate environment.

- Rising Rates: Over the past few years, central banks, including the U.S. Federal Reserve, have raised interest rates to combat inflation. This has resulted in higher borrowing costs across many types of loans, from mortgages to credit cards.

- Interest Rate Caps: In response to market volatility, many lenders offering adjustable-rate loans have introduced interest rate caps. These caps limit how much the rate can increase over a certain period or for the life of the loan, offering some protection to borrowers.

- Hybrid Loans: In recent years, many lenders have introduced hybrid loan products, which combine elements of both fixed and adjustable-rate loans. For instance, a borrower might have a fixed rate for the first five years of a mortgage, after which the rate becomes adjustable. These hybrid loans are designed to offer the stability of a fixed rate initially with the potential savings of an adjustable rate later.

Research on Fixed vs. Adjustable Rates

- The Impact of Interest Rate Changes: Research has shown that borrowers with adjustable-rate mortgages (ARMs) are more vulnerable to economic shocks. A 2024 study by the National Bureau of Economic Research (NBER) found that during periods of rising interest rates, households with ARMs were more likely to default on their loans due to payment increases. The same study highlighted that borrowers with fixed-rate loans were more likely to weather the storm, as their payments remained stable.

- Borrower Behavior and Risk Tolerance: A study from the Journal of Economic Behavior & Organization (2023) examined borrower behavior in relation to interest rates. It found that borrowers with a higher tolerance for risk tended to prefer adjustable-rate loans, believing they could take advantage of lower initial rates or short-term fluctuations. However, those with lower risk tolerance favored fixed-rate loans for their predictability, especially in an environment of economic uncertainty.

- Economic Modeling: Economists have used complex modeling to forecast the long-term financial outcomes of fixed vs. adjustable-rate loans. For example, a 2022 analysis from the Brookings Institution concluded that borrowers with fixed-rate loans generally came out ahead in terms of total interest paid over the life of the loan, especially when interest rates rose rapidly. However, borrowers who sold their homes or refinanced within the first five years tended to benefit from adjustable rates, as their payments were lower during the initial period.

Which Type of Loan is Right for You?

The decision between a fixed-rate and an adjustable-rate loan depends on various factors, including:

- Your Financial Situation: If you need stability and have a limited ability to absorb potential rate hikes, a fixed-rate loan is likely the safer option. Conversely, if you expect to move or refinance within a few years, an adjustable-rate loan could provide short-term savings.

- Market Conditions: In a rising interest rate environment, fixed rates may provide long-term cost savings, whereas adjustable rates could expose borrowers to higher payments if rates continue to rise.

- Risk Tolerance: If you are comfortable with uncertainty and can manage fluctuations in your payments, an adjustable-rate loan might work well for you. However, if you prefer to lock in a rate and have consistent payments, a fixed-rate loan is generally the better choice.

Conclusion

In an era of fluctuating interest rates, understanding the differences between fixed and adjustable rates—and knowing how market conditions affect them—can help you make more informed financial decisions. Whether you choose a fixed-rate or adjustable-rate loan should depend on your financial situation, risk tolerance, and the length of time you expect to hold the loan. By considering the pros and cons of each option, you can find the loan structure that best fits your goals and protects you from potential future financial strain.