Introduction

When navigating the complex world of home financing, two key players emerge in the process: mortgage brokers and lenders. While both are crucial in helping homebuyers secure a mortgage, they serve distinct roles. Understanding the differences between these professionals can help borrowers make informed decisions, ensuring they receive the best terms and experience.

1. Defining the Roles: Mortgage Broker vs. Lender

Mortgage Broker: A mortgage broker is a third-party intermediary who connects borrowers with lenders. Brokers act as middlemen, assessing a borrower’s financial situation and then shopping around to find the best mortgage rates and terms from a wide array of lenders. Mortgage brokers do not provide the funds themselves but instead work to match borrowers with a lender that fits their specific needs.

Lender: A lender, on the other hand, is the institution or individual that directly provides the loan to the borrower. Lenders could be banks, credit unions, or private mortgage companies. They assess the borrower’s creditworthiness and approve or deny loan applications based on the borrower’s ability to repay. Lenders set the terms of the loan, including the interest rate, loan amount, and repayment schedule.

2. Roles and Responsibilities in the Mortgage Process

Both mortgage brokers and lenders play key roles throughout the mortgage process. Here’s a breakdown of their responsibilities:

- Mortgage Broker:

- Loan Shopping: Brokers access multiple lenders and compare loan products to find the most suitable one for the borrower.

- Guidance and Advice: Brokers offer personalized advice, helping borrowers understand the types of loans available, such as fixed-rate, adjustable-rate, or government-backed loans (FHA, VA, USDA).

- Paperwork Handling: Brokers assist in gathering required documentation and submitting applications to the lender.

- Negotiation: They can sometimes negotiate loan terms, such as fees and rates, on behalf of the borrower.

- Customer Service: Brokers are usually the primary point of contact for the borrower throughout the loan process, offering ongoing support.

- Loan Shopping: Brokers access multiple lenders and compare loan products to find the most suitable one for the borrower.

- Lender:

- Loan Origination: Lenders create and issue the mortgage loan.

- Underwriting: Lenders are responsible for underwriting the loan, which involves verifying the borrower’s creditworthiness and evaluating the risk.

- Loan Approval or Denial: Lenders have the final say in whether the loan is approved, based on underwriting criteria.

- Disbursement of Funds: Once the loan is approved, the lender provides the necessary funds to complete the transaction.

- Customer Support: Lenders maintain the mortgage after it is issued, including managing payments, taxes, and escrow accounts.

- Loan Origination: Lenders create and issue the mortgage loan.

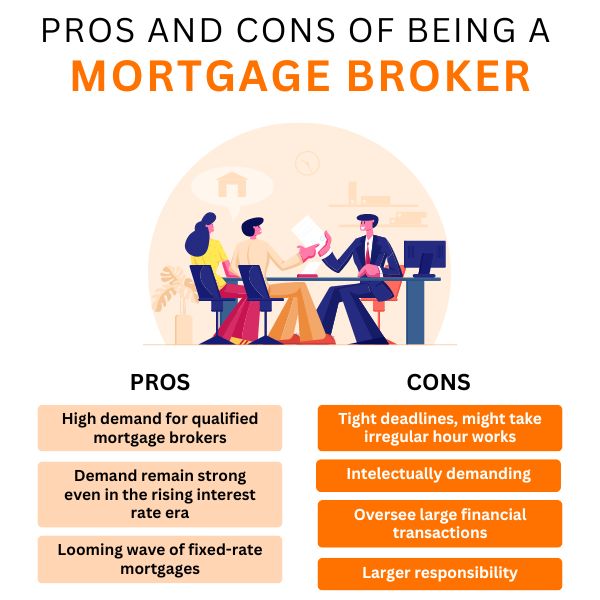

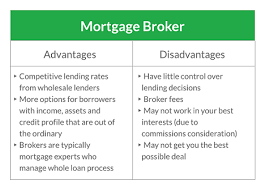

3. Comparing the Advantages and Disadvantages

The decision between working with a mortgage broker or directly with a lender largely depends on individual preferences and the borrower’s situation. Here’s a comparison of the advantages and disadvantages:

- Advantages of Using a Mortgage Broker:

- Access to Multiple Lenders: Brokers have access to a wide range of lenders and mortgage products, which can increase the chances of finding the best deal for the borrower.

- Expertise: Mortgage brokers are well-versed in the mortgage market and can provide tailored advice and guidance, especially for first-time homebuyers.

- Time-Saving: Brokers can save borrowers time by handling much of the legwork, including paperwork and lender communication.

- Potential for Better Rates: Brokers may have access to exclusive deals or lower rates that aren’t available to individual borrowers working directly with lenders.

- Access to Multiple Lenders: Brokers have access to a wide range of lenders and mortgage products, which can increase the chances of finding the best deal for the borrower.

- Disadvantages of Using a Mortgage Broker:

- Broker Fees: Mortgage brokers charge fees for their services, either from the borrower or the lender. These fees can add up and potentially negate some of the savings from a lower interest rate.

- Limited Control: Borrowers may have less control over the loan approval process as brokers handle much of the communication and negotiation.

- Broker Fees: Mortgage brokers charge fees for their services, either from the borrower or the lender. These fees can add up and potentially negate some of the savings from a lower interest rate.

- Advantages of Working Directly with a Lender:

- Simplicity: Working directly with a lender can simplify the process, especially if the borrower is already familiar with the lender or has a pre-existing relationship.

- Cost-Effectiveness: There are no broker fees when working directly with a lender, which could save the borrower money.

- Control: Borrowers have direct communication with the lender and can ensure that they fully understand the loan terms and conditions.

- Specialized Products: Some lenders may offer specialized products or promotions for certain borrowers, such as first-time homebuyers, veterans, or those looking for a particular loan type.

- Simplicity: Working directly with a lender can simplify the process, especially if the borrower is already familiar with the lender or has a pre-existing relationship.

- Disadvantages of Working Directly with a Lender:

- Limited Options: Lenders typically offer only their own loan products, so borrowers may miss out on potentially better deals from other institutions.

- Less Personalized Advice: While lenders will help guide borrowers through the loan process, they may not provide the level of personalized advice or options that a broker can offer.

- Limited Options: Lenders typically offer only their own loan products, so borrowers may miss out on potentially better deals from other institutions.

4. Current Trends and Research in the Mortgage Market

Recent research and trends in the mortgage industry shed light on the evolving role of both mortgage brokers and lenders:

- The Rise of Digital Mortgage Platforms: Online mortgage brokers and lenders are gaining traction. Digital platforms streamline the application process, reduce paperwork, and allow for more transparency. Mortgage brokers have embraced technology to connect borrowers with lenders, while traditional lenders are investing heavily in online tools to enhance the customer experience.

- Research: According to a 2023 study by the National Association of Mortgage Brokers (NAMB), nearly 40% of all mortgage transactions in the U.S. now involve some form of online broker or lender platform, reflecting the shift towards digital.

- Research: According to a 2023 study by the National Association of Mortgage Brokers (NAMB), nearly 40% of all mortgage transactions in the U.S. now involve some form of online broker or lender platform, reflecting the shift towards digital.

- Regulatory Changes and Consumer Protection: The mortgage industry has seen a heightened focus on consumer protection, particularly following the 2008 financial crisis. New regulations, such as the Dodd-Frank Act and the Truth in Lending Act (TILA), have reshaped the roles of both brokers and lenders by requiring greater transparency in the lending process.

- Research: A report by the Consumer Financial Protection Bureau (CFPB) in 2022 found that while brokers often help borrowers secure better deals, the level of consumer protection and transparency varies by broker and lender. The report emphasized that brokers must provide full disclosure of fees and any potential conflicts of interest.

- Research: A report by the Consumer Financial Protection Bureau (CFPB) in 2022 found that while brokers often help borrowers secure better deals, the level of consumer protection and transparency varies by broker and lender. The report emphasized that brokers must provide full disclosure of fees and any potential conflicts of interest.

- Cost Comparison: A study by the Federal Reserve Bank of New York in 2023 revealed that borrowers who work with mortgage brokers tend to secure slightly lower interest rates than those who go directly to a lender. However, the overall savings depend on the broker’s fees and the specific loan products offered.

- Research: The Federal Trade Commission (FTC) reported that in some cases, brokers charge higher fees than lenders, which can offset any interest rate savings. However, brokers often deliver a more comprehensive service that includes personalized advice and access to a wider range of products.

- Research: The Federal Trade Commission (FTC) reported that in some cases, brokers charge higher fees than lenders, which can offset any interest rate savings. However, brokers often deliver a more comprehensive service that includes personalized advice and access to a wider range of products.

5. Which Option is Best for You?

Deciding whether to use a mortgage broker or work directly with a lender depends on a variety of factors:

- Complexity of Your Financial Situation: If your financial situation is more complicated (e.g., self-employed, low credit score), a mortgage broker may be able to help you navigate the mortgage landscape and find a suitable lender.

- Preference for Convenience: If you prefer a streamlined process and have no preference for specific loan products, working directly with a lender might be the easiest route.

- Desire for a Lower Rate: If securing the lowest possible rate is a top priority, a mortgage broker’s wide network of lenders could be beneficial.

Conclusion

Both mortgage brokers and lenders play vital roles in the home financing process. While brokers offer the advantage of access to multiple lenders and personalized guidance, lenders provide the actual funds and have direct control over the loan terms. Borrowers should weigh the advantages and disadvantages of both options and consider their own financial situation and goals. In an increasingly digital world, both options are becoming more accessible, giving borrowers more flexibility and control over their home financing decisions.