Introduction

In the world of home buying, understanding the nuances of mortgage processes can save both time and frustration. Two key terms you’ll often hear are pre-qualification and pre-approval, but what exactly do they mean, and how do they differ? Here’s a breakdown based on current research and best practices in the mortgage industry.

Pre-Qualification: A First Step in the Mortgage Process

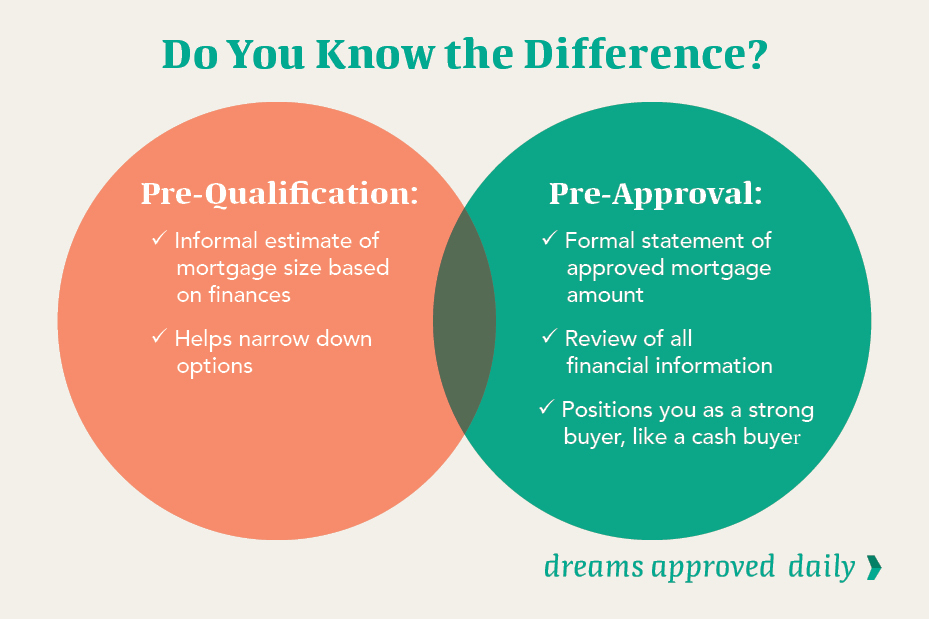

Pre-qualification is the initial stage in securing a mortgage. During this process, a lender gives you an estimate of how much you could potentially borrow based on the information you provide, typically through an online form or a brief conversation with a loan officer.

How it Works:

- You provide basic financial information, including your income, debts, assets, and credit score.

- The lender runs a simple assessment to determine a rough estimate of your borrowing capacity.

- The lender does not typically pull your credit report, and your income or assets are not verified.

Benefits of Pre-Qualification:

- Quick and Easy: It’s a relatively simple and fast process, often taking only a few minutes or hours.

- Estimate of Affordability: It gives homebuyers a rough idea of how much they might be able to borrow and helps narrow down their price range.

- No Impact on Credit Score: Since it doesn’t require a hard credit pull, it doesn’t affect your credit score.

Limitations:

- Less Accuracy: Since pre-qualification is based on self-reported information, it’s less reliable. The actual loan amount you qualify for might differ once you go through the full application process.

- No Guarantee: Pre-qualification doesn’t give you a definitive commitment from the lender. It’s more of an initial estimate.

Pre-Approval: A More Detailed and Reliable Process

Pre-approval, on the other hand, is a more formal and thorough process. In this stage, lenders not only evaluate your financial situation in detail but also verify your information and conduct a hard credit inquiry. As a result, a pre-approval letter carries much more weight when you’re shopping for homes.

How it Works:

- You complete a formal application that includes detailed information about your finances.

- The lender reviews documents like pay stubs, tax returns, bank statements, and any other relevant financial documentation.

- The lender conducts a credit check, which will affect your credit score.

- If everything checks out, the lender will issue a pre-approval letter that specifies the amount you are approved to borrow.

Benefits of Pre-Approval:

- Stronger Buying Position: Sellers and real estate agents take pre-approval seriously. It shows you’re a serious buyer with the financial backing to make an offer.

- Accurate Estimate: Because the lender has verified your information, the pre-approval gives a much more accurate picture of how much you can borrow.

- Faster Process Later On: If you’re pre-approved, the formal approval process can move more quickly when you find a home you want to purchase.

Limitations:

- Time-Consuming: It requires more paperwork, documentation, and time compared to pre-qualification.

- Credit Score Impact: Because it involves a hard inquiry on your credit, your score could drop slightly.

- Conditions: The pre-approval is based on your current financial situation. If your situation changes (e.g., job loss or taking on more debt), the pre-approval could be revoked.

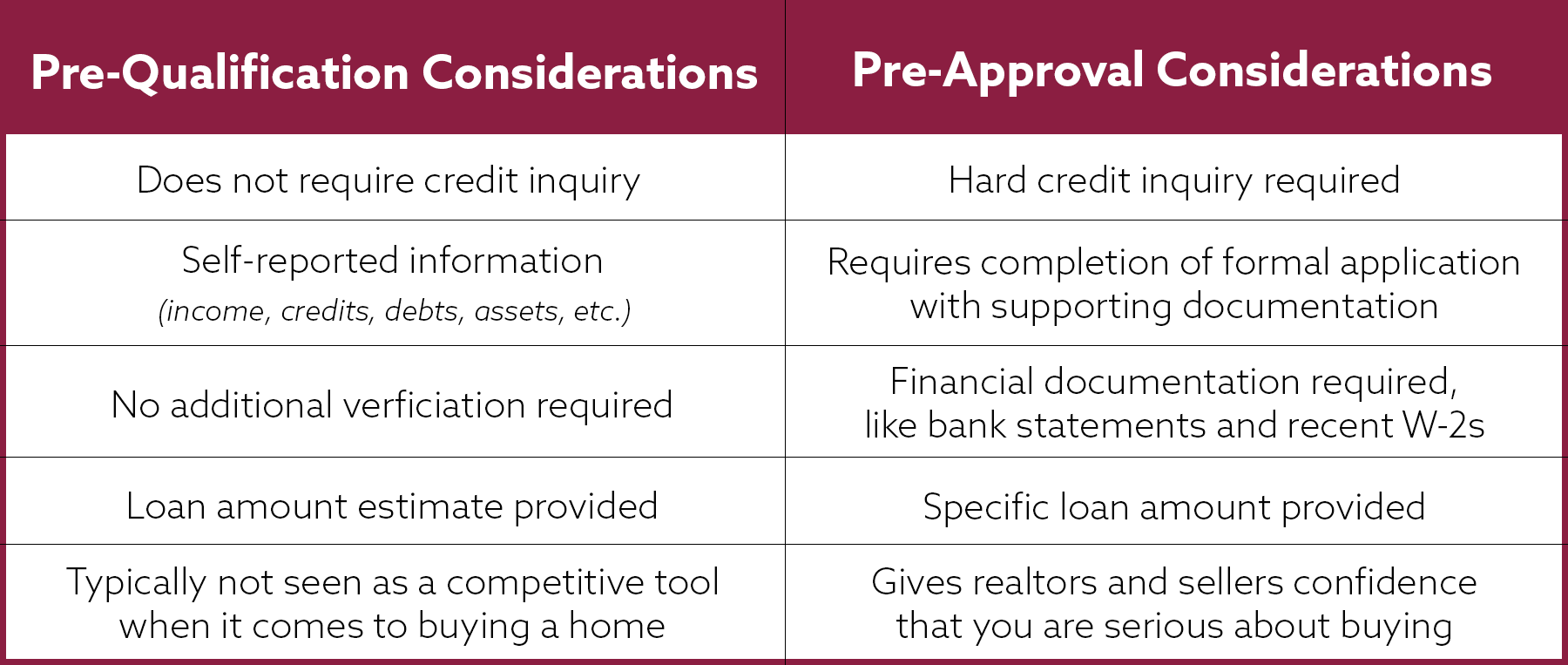

Key Differences Between Pre-Qualification and Pre-Approval

| Aspect | Pre-Qualification | Pre-Approval |

| Process | Informal; self-reported info | Formal; verified documentation |

| Credit Check | No hard credit inquiry | Hard credit inquiry (impacts score) |

| Time Frame | Quick (minutes to hours) | Longer (days to weeks) |

| Accuracy | Estimated, less accurate | More accurate, based on verified info |

| Impact on Home Search | Limited, no seller confidence | Strong, seller sees you as serious |

| Commitment | No formal commitment | Lender commits to a loan amount |

Why Pre-Approval is Better for Serious Homebuyers

For anyone seriously considering purchasing a home, pre-approval is generally the better option. It provides a concrete estimate of your borrowing capacity and signals to sellers that you are a qualified buyer. This can be particularly important in competitive housing markets where sellers are more likely to entertain offers from pre-approved buyers.

While pre-qualification is a helpful first step, it doesn’t provide the same level of confidence to sellers. It may be a good idea to get pre-qualified initially to gauge your borrowing power, but getting pre-approved before you start making offers can give you a significant edge.

What Happens After Pre-Approval?

Once you’ve obtained a pre-approval letter, the next steps are as follows:

- House Hunting: With a clear budget, you can now shop for homes within your price range.

- Making an Offer: When you find the home you want, the pre-approval letter can be included with your offer to show the seller you’re financially capable of completing the purchase.

- Underwriting: Once your offer is accepted, the lender will begin the underwriting process to finalize the loan. This may involve additional checks and documentation, but since you’ve already been pre-approved, this step is often faster.

- Closing: If all goes well, you’ll proceed to closing and officially purchase your home.

Current Trends in the Mortgage Industry

- Increased Use of Technology: Many lenders now offer digital pre-qualification and pre-approval processes, using artificial intelligence and automated systems to speed up and simplify the process.

- Impact of Interest Rates: Fluctuating interest rates are making pre-approval even more important. With higher interest rates, it’s crucial to know exactly what you can afford to avoid overextending your budget.

- Pre-Approval as a Seller’s Requirement: In some competitive real estate markets, sellers are increasingly requiring pre-approval letters before they’ll even consider offers, further cementing the importance of this step.

- Changing Mortgage Guidelines: Lenders are also refining their criteria and making adjustments to pre-approval requirements based on recent economic shifts, such as tighter lending regulations in response to economic uncertainty.

Conclusion: Which One Should You Choose?

While pre-qualification is a good first step, if you’re serious about purchasing a home, pre-approval is the way to go. It provides you with a clearer understanding of your budget and strengthens your position as a buyer. In a competitive market, pre-approval can make the difference between landing your dream home or losing out to a better-prepared buyer.

Ultimately, pre-qualification is an estimate based on self-reported information, while pre-approval involves a more in-depth review of your finances. The more thorough the process, the stronger your position will be when it comes time to make an offer.

Whether you start with pre-qualification or go straight to pre-approval, knowing the difference is key to navigating the home-buying journey successfully.

Sources and Current Research

- Mortgage Bankers Association (MBA): Data on trends in mortgage applications and pre-approval rates.

- Fannie Mae and Freddie Mac Reports: Industry guidelines for pre-qualification and pre-approval processes.

- National Association of Realtors (NAR): Insights on how pre-approval letters are influencing homebuyer success in the current market.

- Recent Market Trends: Data from Redfin, Zillow, and other real estate sources on the impact of pre-approval in competitive housing markets.